Content

The interest rates on certificates of deposit (CDs) vary but tend to be higher than those on other bank accounts, such as checking or savings accounts. Saving accounts are bank accounts where the depositor can make deposits and withdrawals and earn interest on the deposited funds. The interest rates on savings accounts vary; they tend to be lower than those on certificates of deposit but higher than those on checking accounts..

If home values appreciate 4.3 percent in 2020, as the National Association of Realtors predicts, the value of your home would increase to $345,650. The appreciation rate is the rate at which appreciated meaning in accounting an asset’s value grows. A, Experiential aprreciation, small Self, and positive affect as mediators. B, Experiential aprreciation and tripartite components of meaning as mediators.

Life Appreciation, Mattering, Purpose and Coherence

Our real estate reporters and editors focus on educating consumers about this life-changing transaction and how to navigate the complex and ever-changing housing market. From finding an agent to closing and beyond, our goal is to help you feel confident that you’re making the best, and smartest, real estate deal possible. One metric a community can use to evaluate how well they are investing is to calculate their Capital Asset Depreciation ratio. This is the ratio of Accumulated Depreciation to Gross Depreciable Assets, excluding land and construction in progress. The closer to 1.0 or 100% the closer the assets are to being fully depreciated. In fact, much above 60-65% means a community needs to be actively evaluating in their assets and could indicate necessary investment is imminent.

Remember finally, that the seller increases (credits) a Sales revenue account when the original sale closes. “Loss on inventory” appears with other noncash expenses on the SCFP under “Sources of cash,” serving ultimately to lower reported cash inflows. In brief, asset revaluation calls for a thorough and detailed knowledge of country-specific GAAP (Generally Accepted Accounting Principles), country-specific regulatory requirements, and country-specific tax laws. It is nevertheless possible for firms to revalue assets undergoing depreciation or amortization.

Explore content

Coherence, purpose, mattering and both covariates also significantly predicted MIL (Extended Data Fig. 1). For example, say you purchased a home in April 2019 for the nationwide median sale price at the time, which was $289,052, according to Redfin data. If that home were now valued at the April 2022 nationwide median sale price of $424,146, that would be an appreciation rate of 46.7 percent. ($424,146 minus $289,052 equals $135,094, and $135,094 divided by $289,052 equals 0.467.) An online percentage change calculator can help you run the numbers. Buying or selling a home is one of the biggest financial decisions an individual will ever make.

Inventories are normally appear under the balance sheet category Current assets. In any case, firms initially report inventory value at cost, but inventory value can change upwards due to appreciation or downwards due to impairment (spoilage, theft, obsolescence, or general reduction in market demand). Appreciation is an increase in the value of an asset over time. This is one of the main reasons why investors hold certain assets, such as common stock, real estate, rare coins, and artwork.

However, it is unclear whether they encompass all information people consider when judging MIL. Based on the ideas of classic and contemporary MIL scholars, the current research examines whether valuing one’s life experiences, or experiential appreciation, constitutes another unique contributor to MIL. Overall, these findings support the hypothesis that valuing one’s experiences is uniquely tied to perceptions of meaning. Implications for the incorporation of experiential appreciation as a fundamental antecedent of MIL are discussed. Although many universal and idiosyncratic sources bear on the subjective experience of MIL, the core of this experience is influenced by several primary indicators of a higher-level general sense of MIL.

Reflexive Property (Travel and Tours Themed) Math Worksheets

Because companies are required to account for any appreciation of their assets, annual reports often contain references to any assets that have appreciated. Financial media look hard at the appreciation of a company’s assets too, especially as it can make the company more attractive as a potential target for a takeover. The possibility of an increase in the value of the asset over time encourages investors to purchase financial assets to earn a profit. A good appreciation rate is relative to the asset and risk involved. What might be a good appreciation rate for real estate is different than what is a good appreciation rate for a certain currency given the risk involved.

- If you’re looking for a more enjoyable house now with a greater resale value later, here are a few projects worth focusing on.

- Rely on the premier business encyclopedia to sharpen your grasp of essential business concepts, terms, and skills.

- The appreciation rate is virtually the same as the compound annual growth rate (CAGR).

We can utilize the annual appreciation rate to anticipate the value after each year by making repeated percentage increases. For a property worth $50000, we can calculate its value after t years with 0.5% yearly appreciation. Let us say, for instance, you may determine whether a specific purchase is worth making by learning how to calculate the appreciation or depreciation value of an item or investment.

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Where the taxpayers choose to make periodic reports, they should file their choice with the local tax bureaus in the locale where the property is situated. Any educational surcharge paid by the taxpayers in the transfer of real estate may also be deducted as tax paid. All content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only.

Estimate 6. Post-impairment depreciation expense

In addition, the average rate of home appreciation varies greatly by location. For instance, the home appreciation rate in Colorado was 19.7 percent from December 2020 to December 2021, while the rate in Illinois over the same time period was 11.9 percent. Breaking down statistics by county and by city yields even more drastic differences. Within 7 days of the date that the contract governing the transfer of the real estate is signed, the taxpayer should report to the relevant local tax office in the locale where the real estate is situated.

- A lease is a contract permitting one party to use another’s property over a specific period of time in exchange for rent payments, and sets terms and conditions for the rental.

- Julio invested $1200 in a company, and his money appreciates at 4% each year.

- For example, the toilet, sink, and roof break down as they progress through their lifespan.

- Although many universal and idiosyncratic sources bear on the subjective experience of MIL, the core of this experience is influenced by several primary indicators of a higher-level general sense of MIL.

- What might be a good appreciation rate for real estate is different than what is a good appreciation rate for a certain currency given the risk involved.

- You never know when these details will factor into major business decision down the line.

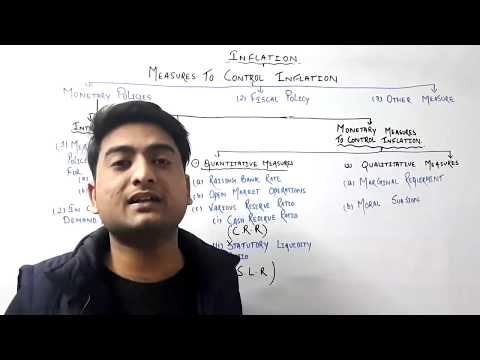

Appreciation and depreciation are fundamental principles to understand for any small business owner. Appreciation logs any increase in the value of your assets over time, while depreciation logs any decrease in the value of your assets over time. Currency appreciation affects the prices of international transactions. Now, residents can afford to buy more foreign goods, which leads to increased demand for imports. On the other hand, when a country’s currency appreciates, its goods become more expensive to foreign customers. In economics, inflation occurs when the general prices for goods and services increase.

Estimate 5. Impairment Value

Accountants define asset revaluation as the process of changing asset book values upwards or downwards, to report values more realistically. Revaluation is the company’s formal announcement that earlier asset values and metrics are no longer accurate or realistic. In general,, the term depreciate is more or less the opposite of appreciate. Like appreciate, depreciate has a broader meaning in general business usage but a narrower and more specific meaning in accounting.

Get our tips on big-picture strategy and actionable tactics for startup equity, small businesses, crypto, real estate, and more. The following are some examples of applications of appreciation and depreciation in real life. The difference between an investment’s previous value and its present or future value is known as appreciation.

Extended data

The calculations below show the yearly appreciation value of the property. The table below shows the appreciation of the value of the property after t number of years. When failure is not an option, wise project managers rely on the power of statistical process control to uncover hidden schedule risks, build teamwork, and guarantee on-time delivery. Take control of asset TCO and prevent nasty cost surprises later. Clear, practical, in-depth guide to principle-based case building, forecasting, and business case proof. For analysts, decision makers, planners, managers, project leaders—professionals aiming to master the art of “making the case” in real-world business today.